Reliable and Professional Conveyancing Services in Canberra

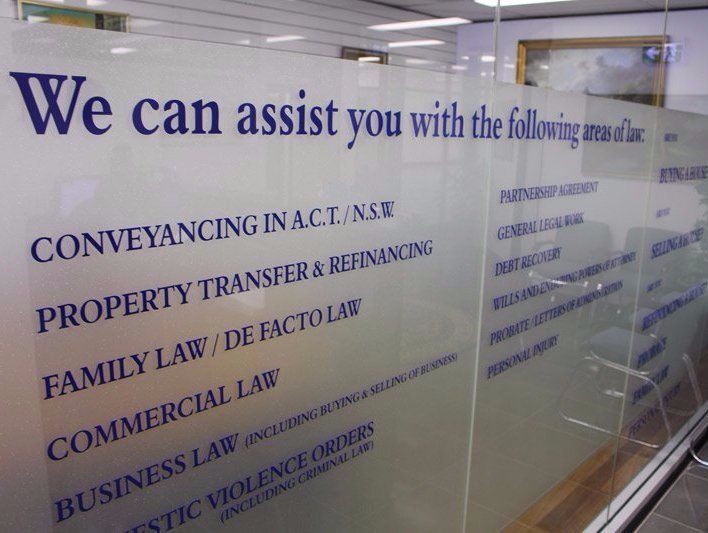

Are you looking for reliable and efficient conveyancing services in Canberra? At Ray Swift Moutrage & Associates, we understand the importance of smooth property transactions, whether you’re buying or selling. Our team of experienced legal professionals is dedicated to providing clear, comprehensive conveyancing support tailored to your personal needs. For detailed assistance, call us today at 02 6285 1344.

Details of Conveyancing Services

Conveyancing can seem daunting, especially if you’re unfamiliar with the process. However, our team at Ray Swift Moutrage & Associates makes it simple. We guide you every step of the way, ensuring all legal requirements are met with precision and care. Whether you’re a first-time homebuyer or an experienced property investor, our conveyancing services are designed to provide peace of mind. Our proactive approach minimises delays and helps you understand each phase of your property transaction.

Benefits of Choosing Our Conveyancing Services

- Streamlined Process: We simplify legal complexities, ensuring a swift and straightforward conveyancing experience.

- Personalised Attention: Every client’s situation is unique, which is why we offer tailored solutions to meet specific needs and preferences.

- Expert Advice: Backed by years of experience in Canberra’s property market, our lawyers provide expert advice that you can trust.

Our team at Ray Swift Moutrage & Associates is committed to delivering not just results but also a stress-free experience. We ensure that each aspect of your property transaction is handled with professionalism and attention to detail, reflecting our firm’s cornerstone values of trust and integrity.

Our fees for conveyancing:

- $1700* (plus GST) for standard Purchase in ACT

- $1700* (plus GST) for standard Sale in ACT

- $2000* (plus GST) for standard Purchase in NSW

- $2000* (plus GST) for standard Sale in NSW

- $2500* (plus GST) for standard Rural Sale

- Reviewing of Auction contracts or Purchase Contracts $450 (plus GST) per hour**

- $1350* (plus GST) for Retirement Village Agreements/Contracts

- ACT/NSW Transfer/Refinances/Transmission Applications $450* (plus GST) per hour - minimum 2 hours

*Plus disbursements depending on the type of property being sold or purchased.

**This fee is payable whether you choose to proceed or not.

Conveyancing in Canberra

At Ray Swift Moutrage & Associates, we specialise in providing reliable and professional conveyancing in Canberra for property buyers, sellers, and investors. Whether you are purchasing your first home, transferring a property, or finalising a commercial deal, our dedicated legal team ensures a smooth and stress-free process. Call us today at (02) 6285 1344 to book your consultation and get expert legal support tailored to your needs.

Ray Swift Moutrage & Associates provides trusted support for conveyancing in Canberra, helping buyers and sellers move forward with confidence. Our team offers clear guidance and practical help from start to finish. If you need fast assistance, call 02 6285 1344 for friendly support and answers.

Professional Help for Your Property Needs

Ray Swift Moutrage & Associates understands that buying or selling property is a major step. We ensure every stage of the process is simple and clear. With our team guiding you, you receive reliable help and complete information. We make conveyancing in Canberra easier by keeping you informed from the first meeting to final settlement.

Our team focuses on preparing documents, checking contracts, and explaining important steps in plain language. These tasks are a key part of any property transfer, and we complete them with care. You can rely on us to support you with each detail as you move towards settlement. We aim to reduce stress and give you peace of mind through consistent communication.

Take the Next Step Today

If you are planning a property transfer, our team is ready to help. Ray Swift Moutrage & Associates will guide you through each stage of conveyancing in Canberra with care and confidence. For quick support or to begin your matter, call 02 6285 1344 or visit our contact page to get started.

Professional Conveyancing Services in Canberra

When it comes to conveyancing in Canberra, attention to detail and efficiency are key. At Ray Swift Moutrage & Associates, we handle every step of the process, from preparing contracts to managing settlement. Our experienced team guides you through property law complexities, ensuring compliance with all regulations and safeguarding your rights. We support individuals, families, and businesses, providing clarity and confidence at each stage of the transaction.

Whether you are purchasing residential property, selling land, or entering into a commercial arrangement, our expertise guarantees peace of mind. By choosing us, you’re not only protecting your investment but also securing a smooth transition of ownership with minimal stress.

FAQs About Conveyancing in Canberra

What is Conveyancing in Canberra and Why is it so Important?

Conveyancing in Canberra is the complete legal process of transferring property ownership, which ensures that both buyer and seller meet their obligations under ACT law. Without professional guidance, errors in contracts, missed disclosures, or incorrect settlement procedures can cause costly disputes. A qualified legal team ensures the process is compliant, accurate, and protects your interests.

How Long Does the Conveyancing Process Usually Take in Canberra?

The timeline for conveyancing in Canberra can vary depending on the complexity of the transaction. Typically, most settlements take around six to eight weeks. However, factors such as finance approval, required property searches, and negotiations between parties can extend this timeframe. Working with an experienced legal firm helps avoid delays and keeps the process moving smoothly.

Can I Complete Conveyancing Without a Lawyer?

While technically possible, handling conveyancing without legal support is risky. Property transactions require precise documentation, legal compliance, and careful review of contracts. A single error can result in financial loss or disputes that may be costly to resolve. Having a professional team ensures your rights are protected, obligations are met, and your investment remains secure throughout the process.

What Costs Should I Expect When Using a Conveyancing Service?

The costs for conveyancing include both legal fees and additional disbursements such as title searches, land registry fees, and government charges. At Ray Swift Moutrage & Associates, we provide a clear cost breakdown upfront so you know exactly what to expect. Our transparent approach ensures you can budget confidently with no hidden charges or surprises.

Why Choose Ray Swift Moutrage & Associates for Conveyancing in Canberra?

Choosing Ray Swift Moutrage & Associates for your conveyancing in Canberra means gaining the benefit of decades of local property law experience. We combine personalised service with meticulous attention to detail, ensuring every transaction is legally sound. Clients rely on our clear communication, proven track record, and commitment to protecting their property interests from start to finish.

Contact Us Today

For trusted conveyancing in Canberra, choose Ray Swift Moutrage & Associates. Our experienced team is here to make your property transaction smooth, secure, and stress-free. Contact us now to book your consultation.

Secure your future with confidence, contact us today!